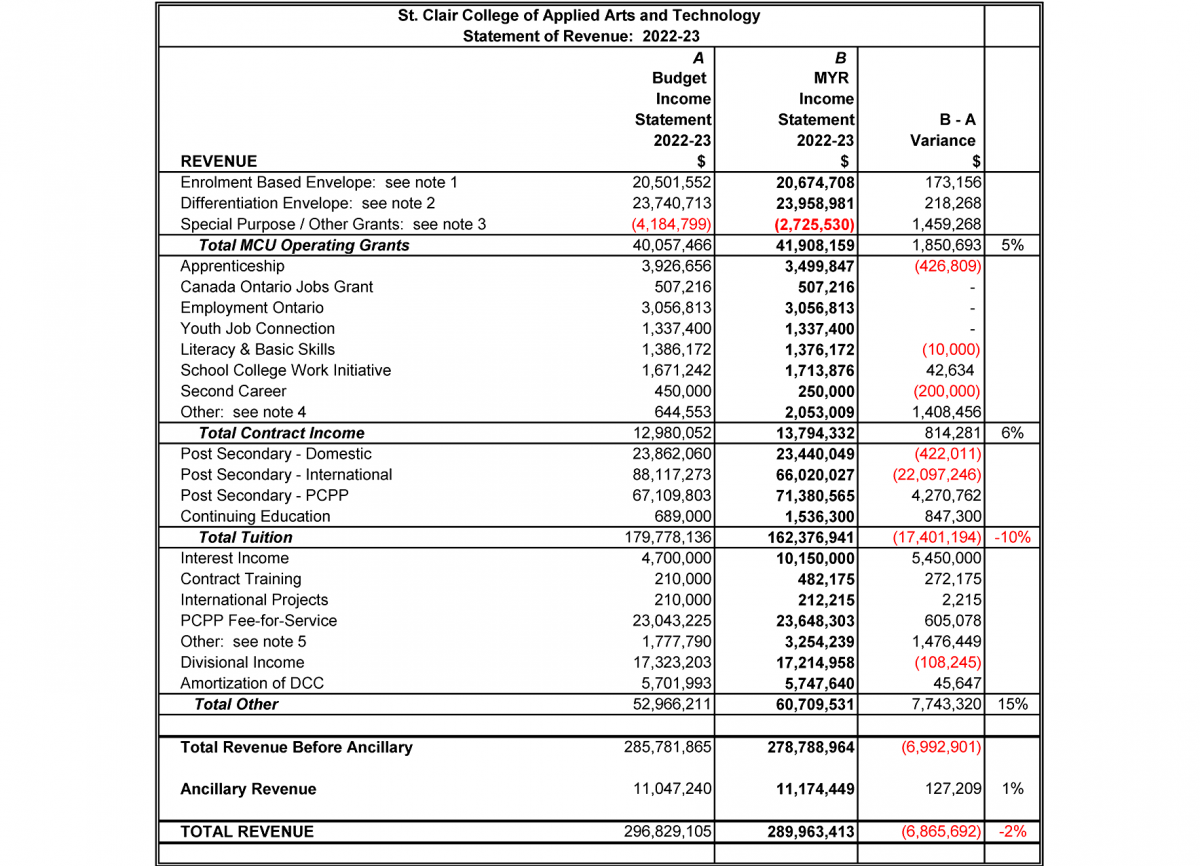

GRAPHIC ABOVE: Left column, the original budgetary numbers from last March. Middle column, the mid-year revisions. Right column, the differences between the two.

Upon the recommendation of Chief Financial Office/Vice-President of Finance Marc Jones and the administration, the college’s Board of Governors revised its 2022-23 financial forecast during its November 22nd meeting, to reduce its projected year-end surplus by $2.8 million.

Even with that reduction, the administration still expects to end the fiscal year at the end of March (2023) with an “operating profit” of $30.1 million.

If achieved, that will be the fifth consecutive year that St. Clair will wrap up its fiscal year with a surplus in excess of $20 million.

Both elements of the financial picture – revenues and expenditures – were amended by Jones in his mid-year adjustment, as he now has over six months of “actuals” in-hand to merit revisions to the budget that was passed last March.

(Like the provincial government, the college operates on a fiscal year of April 1 to March 31.)

His full explanation to the Board is here:

The purpose of the mid-year budget is to review our financial plan based on six months activity, and to project whether the planned year-end results will be achieved without significant adjustments to operations. If adjustments are required, appropriate action steps are developed as part of the review process.

The 2022-23 budget approved by the Board on March 22, 2022 provided for a surplus position of $32,908,357. At that meeting, administration provided the Board with an update on the ongoing budget pressures and risks.

Administration continues to move forward with capital expenditures and operational requirements within the framework of the current Strategic Directions.

Based on the mid-year review analysis, the college is (now) projecting a surplus position of $30,112,480 at March 31, 2023, which is $2,795,877 lower than the original budget surplus position.

The revised projection for total operating and ancillary revenue for 2022-23 is $289,963,413, representing a decrease of $6,865,692 or two percent over the original budget of $296,829,105.

The revised projection for total operating and ancillary expenditures for 2022-23 is $259,850,933 representing a decrease of $4,069,815 or two percent over the original budget of $263,920,749.

CHANGES TO REVENUE

Overall, revenues decreased by $6,865,692 or two percent over the original budget. The following highlights compare the original budget approved by the Board to some of the major changes in revenue:

• Total Ministry of Colleges and Universities Operating Grants increased by $1,850,693 or five percent over the original budget, primarily due to a decrease in the ministry’s International Student Recovery program of $1,206,000 because of lower international student enrolment than planned.

• Total Contract Income increased by $814,281 or six percent over the original budget due to the following:

- Decrease in the Apprenticeship Grant of $426,809 due to lower registrations relative to the funded seat plan;

- Increase in “Other” due to the Ontario government’s approximate funding of $1,500,564 for an accelerated Personal Support Worker 2.0 program that covers students’ tuition and other expenses, allowing participants to graduate with full credentials in six months. This second year of funding was unknown when the budget was originally developed.

• Total Tuition revenue decreased by $17,401,194 or ten percent over the original budget due to the following:

- Decrease in the Domestic Tuition revenue budget of $422,011 due to lower enrolment. The current year’s fall semester enrolment totaled 6,824 full-time domestic students, compared to a budget assumption of 7,006 students. Domestic Tuition revenue is subject to adjustments for dismissals, withdrawals, and new students enrolling in the Winter semester;

- Decrease in the International Tuition revenue of $22,097,246 due to lower enrolment across the spring and fall semesters. The current year’s fall semester international enrolment totaled 3,470 compared to a budget assumption of 4,650. International Tuition revenue is subject to adjustments for dismissals, withdrawals, student VISA denials, immigration matters, and new students enrolling in the Winter semester;

- Increase in the public/private college partnership Tuition revenue of $4,270,762, due to higher enrolment from the spring semester. The current year’s fall semester international enrolment totaled 3,470 compared to a budget assumption of 3,500. This Tuition revenue is subject to adjustments for dismissals, withdrawals, student VISA denials, immigration matters, and new students enrolling in the Winter semester. (This category refers to St. Clair’s sister school relationship with Toronto’s Ace Acumen Academy – a private school that offers a half-dozen St. Clair-accredited programs.)

• Total “Other” income increased by $7,743,320 or 15 percent over the original budget due to the following:

– Increase in Interest Income of $5,450,000 due to significant increases in the Bank of Canada’s policy interest rate and interest realized from maturing GICs;

– Increase in Other Income of $1,476,449 mostly due to administration fees realized from students who registered with St. Clair but subsequently chose to enroll at another institution.

CHANGES IN EXPENDITURES

Overall, expenditures decreased by $4,069,815 or two percent over the original budget. The following highlights compare the original budget approved by the Board to some of the major changes in expenditures:

• Total Salaries and Benefits decreased by $2,545,100 or three percent. The decrease is primarily due to the following:

- Decrease in Full-Time Faculty salaries: $1,203,964;

- Decrease in Part-Time Faculty salaries: $415,923;

- Decrease in Full-Time Support salaries: $1,642,694;

- Decrease in Fringe Benefits: $393,900.

The decrease in Salaries &and Benefits is a result of less active staffing resources than planned due to delayed hires and unplanned retirements.

• Total Non-Salary Expenditures decreased by $1,630,545 or one percent. The decrease is primarily due to the following:

- Increase in Advertising of $1,195,589 due to the college’s recruitment and branding initiatives and support of the new acute care hospital;

- Increase in Contracted Educational Services of $4,343,095 due to higher enrolment than planned at the Toronto Campuses, and flowing the applicable funds to Ace Acumen;

- Decrease in Contracted Services Other of $5,693,151 due to lower agent commissions because of lower international student enrolment;

- Decrease in Instructional Supplies of $1,115,970 due to refinement by the academic sector of its original budget assumptions;

- Decrease in Premise Rental of $765,750 due to international student arrival protocol no longer being active (the college had been housing arriving international students in hotels when pandemic quarantine requirements were in place);

- Increase in Stipends & Allowances & Scholarships of $1,631,820 due to funds being flowed to students enrolled in the accelerated Personal Support Worker 2.0 program;

- Decrease in Amortization of $628,301 due to delays in capital project spending.

The administration continues its on-going efforts of managing expenditures to achieve the overall expenditures budget.

CHANGES IN ANCILLARY OPERATIONS

(Ancillary Operations are the college’s non-academic enterprises: parking, the operation of the convention and banquet business of the Centre for the Arts, the school’s residences, etc.)

The Ancillary Operations overall original budget surplus of $1,241,671 has increased by $21,380 to a mid-year budget surplus of $1,263,051. This is due to adjustments to the revenue forecasts for the College’s Parking and Residence operations.

SEE, ALSO, THE REPORT TO THE BOARD ABOUT CREDIT-TRANSFERS WITH OTHER SCHOOLS: https://news.stclair-src.org/need-know-news/transfer-update-highlights-irish-university-partnership