The college is on track to record its fifth consecutive annual budgetary surplus in excess of $20 million.

Vice-President of Finance/Chief Financial Officer Marc Jones provided an update to the Board of Governors during its February 28th meeting.

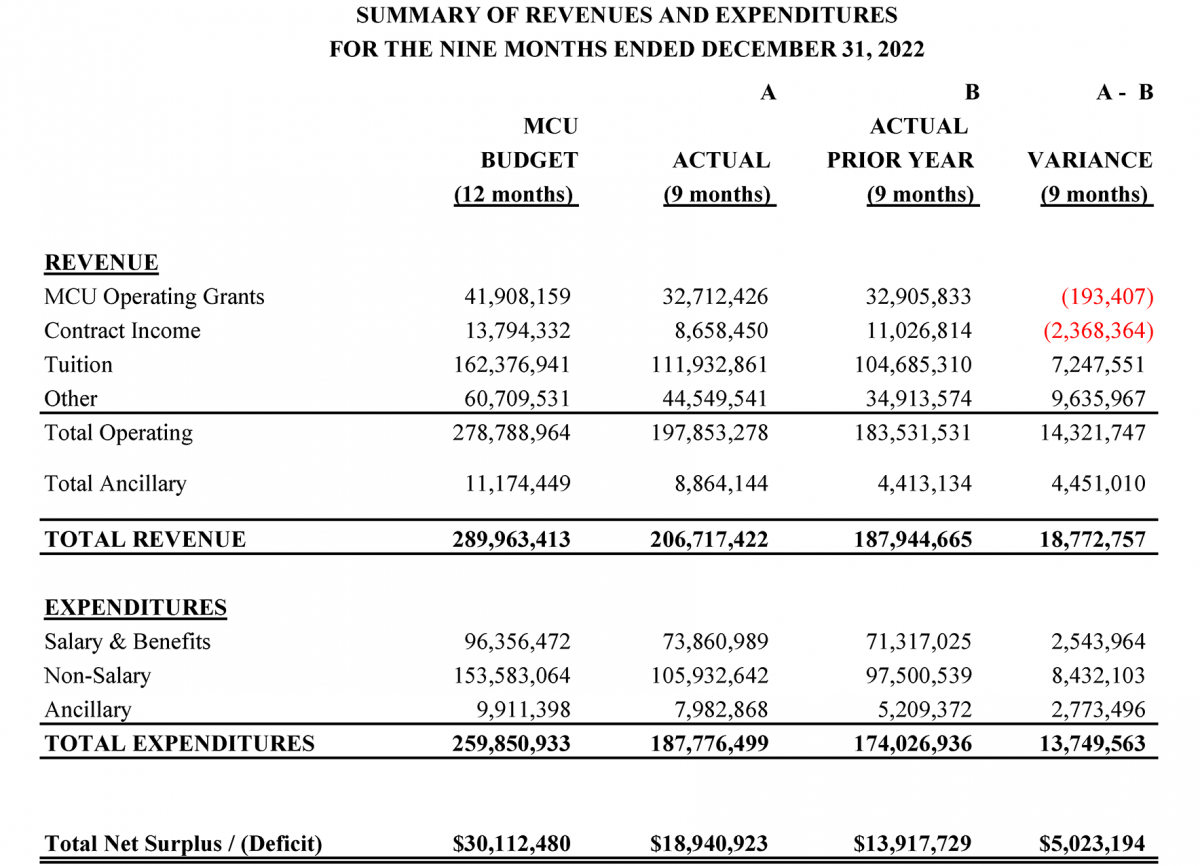

His report was based on the college’s nine-month financials, closing on December 31. (The college, like the provincial government, operates on a fiscal year of April 1 to March 31.)

Jones’ update explained:

The net surplus at December 31, 2022 of $18,940,923 is an increase of $5,023,194 from the net surplus noted for the 2021 comparative period of $13,917,729. The variance is primarily due to (higher revenue and/or lower expenditures in) Tuition Revenue, Contract Income, Interest Income, Public/Private College Partnership Fee-for-Service (St. Clair’s “sister school” relationship with the Toronto area’s Ace Acumen Academy), Divisional Income, Salaries and Benefits, Advertising, Contracted Educational Services, Insurance, Premise Rental, Stipends and Allowances, Amortization, and Ancillary Operations.

The college is on track for our budgeted $30,112,480 surplus (by the year-end on March 31).

(That was the black-and-white text of Jones' report. In his oral presentation to the Board, he remarked that the year-end surplus could approach $40 million.)

REVENUE

The following highlights the major changes in revenue compared to the mid-year budget projections and the 2021 comparative period:

• Ministry of Colleges and Universities (MCU) (basic, per-student-based) Operating Grants are trending above the mid-year budget projection at 78 percent and have decreased over the 2021 comparative period by $193,407 or 0.6 percent.

• Strategic Management Agreement Performance based funding was implemented in 2020-21. The college’s proportion of Enrolment Envelope to Differentiation Envelope funding has shifted from 58 percent and 42 percent (2021-22) to 47 percent and 53 percent (2022-23) respectively. Given the uncertainty regarding COVID-19, in February 2022, the Ministry continued the suspended Performance based funding for one additional year. As a result, these funds are not at risk for 2022-23.

• Contract Income is trending below the mid-year budget projection at 63 percent and has decreased over the 2021 comparative period by $2,368,364 or 21 percent. The decrease is due to lower enrolment in the Ontario government’s funding for an accelerated Personal Support Worker program.

Contract Income is established based on agreements with the Ministry and other partners. The college anticipates being below its budget projections. However, any shortfalls in contract income will be mostly offset by a decrease in expenditures.

• Total Tuition revenue is trending consistent with the mid-year budget projection at 69 percent, and has increased over the 2021 comparative period by $7,247,551 or seven percent due to the following:

– Decrease in Domestic Tuition revenue of $671,921 over the comparative period due to lower enrolment;

– Decrease in International Tuition revenue of $877,840 over the comparative period due to lower enrolment.

– Increase in Ace Acumen-related Tuition revenue of $8,181,418 over the comparative period due to higher enrolment.

• Total “Other” income is trending consistent with the mid-year budget projection at 73 percent and has increased over the 2021 comparative period by $9,635,967 or 28 percent due to the following:\

– Increase in Fee-for-Service of $2,174,170 due to higher enrolment at Ace Acumen;

– Increase in Divisional Income of $2,238,581 due to higher international student insurance fees as a result of higher (Ace Acumen) enrolment, greater grants received for Research and Development, and higher kit/material fees;

– Increase in Interest Income of $3,730,533 due to significant increases in the Bank of Canada’s policy interest rate and interest realized from maturing GICs.

EXPENDITURES

The following highlights the major changes in expenditures compared to the mid-year budget projections and the 2021 comparative period:

• Total Salaries and Benefits are trending consistent with the mid-year budget projection at 77 percent, and have increased over the 2021 comparative period by $2,543,964 or four percent. The increase is primarily due to net new staffing, compensation adjustments, and additional resources to meet the college’s operational needs.

• Total Non-Salary expenditures are trending below the mid-year budget projection at 69 percent, and have increased over the 2021 comparative period by $8,432,103 or nine percent. The increase is due to the following:

– Increase in Advertising as a result of college recruitment and branding initiatives and support of new acute care hospital;

– Increase in Contracted Educational Services as a result of higher enrolment from students attending the Toronto campuses, and flowing the applicable funds to Ace Acumen;

– Increase in Insurance due to new higher international student insurance fees as a result of higher Ace Acumen enrolment, and due to the college’s corporate insurance premiums increasing because of the hardened insurance market;

– Decrease in Premise Rental due to the international student arrival protocol no longer being active;

– Decrease in Stipends and Allowances due to lower enrolment in the accelerated Personal Support Worker program;

– Increase in Amortization due to the college’s significant investment in its capital infrastructure during the prior year.

Many expenditures are cyclical and follow the timing associated with the academic year.

Administration is managing Non-Salary expenditures through ongoing Senior Operating Group review to ensure the overall expenditures budget is met.

ANCILLARY OPERATIONS

The Ancillary (non-academic) Operations surplus of $881,276 is trending below the mid-year budget projection of $1,263,051, and has improved by $1,677,514 over the 2021 comparative period. The improvement over the prior year is primarily due to the St. Clair College Centre for the Arts (banquets, conventions and catering), Parking, and Residence operations, which is partially reduced by a deficit from the St. Clair Fratmen (football team).

MORE STORIES FROM THE BOARD OF GOVERNORS MEETING

• Cancelled and suspended programs: https://news.stclair-src.org/need-know-news/st-clair-packs-away-its-golf-clubs

• The college’s involvement with the community: https://news.stclair-src.org/need-know-news/we-emphasize-community-community-college

• Student Services and “Soft Skills”: https://news.stclair-src.org/need-know-news/sr-clair-shows-its-softer-skilled-side

• The past year of beautifying campuses: https://news.stclair-src.org/need-know-news/knowledge-skills-beauty-weve-got-it-all

• Research and Development expands at St. Clair: https://news.stclair-src.org/need-know-news/rd-expanding-significantly-st-clair

• College expands online offerings: https://news.stclair-src.org/need-know-news/online-course-development-exceeds-goal